BondCliQ CEO Chris White co-authored this provocative market structure blog with Manisha Kimmel, the chief policy officer at MayStreet.

Are there inalienable rights that all markets participants should have when it comes to market data?

SEC Comment Letter: 17a-7 Rule Changes …

Solutions

Minority-Owned Bond Traders Get a Way to Be Seen on Wall Street

By Molly Smith

-

Their price quotes are now in the mix with bigger bond dealers

-

A new link to leading trading software makes them actionable

Bond traders at firms owned by minorities, women and veterans have for years yearned to operate on a level playing field with Wall Street giants. A market-data startup just rolled out something that could help.

BondCliQ, a New York-based firm that offers a centralized feed of real-time bond quotes, in the past two months got added to trading software developed by firms including State Street Corp.’s Charles River. This significantly increases the pool of money managers that can trade against quotes posted by dealers on BondCliQ by connecting them to products used by investors with trillions in assets.

While that will benefit all the dealers on BondCliQ, those with diverse ownership stand to gain the most, founder Chris White said. That’s because they lack the technology and widespread connections across the industry, and BondCliQ is working to promote their bids and offers in particular, White said.

“We’re delivering a piece of architecture that’s missing from the market,” White, a former Goldman Sachs Group Inc. technology executive, said in an interview. “It’s much easier for customers to find the dealer that deserves their order because it’s delivered right into their workflow.”

The deal with Charles River, which caters to investors with more than $30 trillion in assets, could massively increase BondCliQ’s reach since it makes one of the most popular order-management systems for bonds. The connection will help BondCliQ’s nine emerging dealers — or those with diverse ownership — access those investors directly, giving them an opportunity to win more business in a market dominated by the biggest Wall Street banks. Currently, BondCliQ has 14 buyside clients with a combined $750 billion of assets using its data.

Read More: Goldman Alum Touts ‘70s Era Fix to Bond Market’s Big Problem

The bond market is one of the most notoriously opaque corners of finance, where relationships between the buyside and sellside still dictate much of the activity for new debt sales and trading. Technological advancements in the primary and secondary markets are slowly democratizing the business, but the likes of JPMorgan Chase & Co., Bank of America Corp. and Citigroup Inc. still dominate with their vast operations and distribution networks, making it difficult for smaller banks to break through.

“Extracting information in the marketplace is the hardest thing for us to do,” said Carmine Urciuoli, head of fixed-income sales and trading at AmeriVet Securities, which was founded by a Black, disabled veteran. “Having high-quality secondary information is critical to defining a narrative to a client,” whether that’s an investor or an issuer, he said.

(Bloomberg LP, the parent of Bloomberg News, also offers fixed-income trading, data and information to the financial-services industry.)

Improving Distribution

Similar to the early days of Nasdaq, which started out in the 1970s as just a bulletin board for stock quotes posted by dealers before evolving into an exchange giant, BondCliQ aggregates bids and offers for corporate bonds from 41 dealers all in one place. Once the counterparties are connected, they can turn to electronic venues like MarketAxess Holdings Inc. or Tradeweb Markets Inc. or message each other directly to execute the transaction.

BondCliQ’s new tech partners will help simplify how dealers communicate pre-trade data to investors. Buyside participants globally can access BondCliQ quotes via Charles River, which largely caters to U.S. clients, as well as order management systems like Tora, which mostly serves Asia, and IHS Markit Ltd.’s thinkFolio with a European focus, White said.

While they’re starting to gain more traction in the primary market amid record bond sales and renewed attention on social-justice issues after George Floyd’s killing, diverse banks lag behind major Wall Street firms in the secondary market — or trading bonds after their initial issuance. The upstarts have smaller balance sheets, less sophisticated technology and a shorter roster of traders.

Unlike the primary market, where companies sometimes factor in diversity when hiring banks to sell their debt, dealers are on their own in the secondary market, where investors are largely driven by the desire to achieve best execution, no matter who’s on the other side of the trade.

“Maybe before I was the best level, but people didn’t see me,” said Jared Kurtzer, managing partner at American Veterans Group. “Now that I’m on BondCliQ, we can compete with each other and let the best level win.”

A Tale of Two Platforms …

Charles River Development Workflow with BondCliQ Widgets Promo Video: http://bondcliq.com/wp-content/uploads/2021/01/CRD%20Demo%20Video%20%28final%29.mp4

In One Chart

Bank debt leads corporate bond rally sparked by COVID-19 vaccine rollout

Bank debt has been a hot commodity in the near two weeks since the Food and Drug Administration authorized the first COVID-19 vaccine for emergency use in the U.S.

Bonds issued by Bank of America Corp. BAC, -0.35%, JPMorgan Chase & Co. JPM, -0.02% and Citigroup Inc. C, -1.62% on Tuesday topped the list of 40 most-active U.S. corporate bonds traded since Dec. 11, when the FDA greenlighted the first COVID-19 vaccine for distribution in the U.S., according to BondCliq data.

That is when BioNTech BNTX, -5.34% and Pfizer Inc.’s PFE, -0.45% COVID-19 vaccine was waved through to start distribution in the U.S., while a shot developed by Moderna Inc. MRNA, -7.94% is quickly becoming a second option as the nation races to gain control of the pandemic.

Here’s a chart showing the top 40 most actively traded U.S. corporate bonds since the vaccine rollout.

Banks top post-vaccine corporate bond trades BONDCLIQ

The broad rally, led by bank debt, comes after shares of financial companies were pummeled in 2020, with investors initially shunning segments of the economy viewed as vulnerable to the pandemic’s shocks and its aftermath.

Banks not only hold consumer deposits, but they also make real-estate loans and arrange financing, mergers, acquisitions and equity deals for major U.S. corporations, or a direct link to the health of the economy.

In a hopeful sign this fall, debt investors started to change their tune, at least when making shorter-term bets on major banks.

BondCliQ data for December shows the rally in bank debt now has expanded to bonds due in 10 years and beyond, indicating that investors have become more hopeful that a successful vaccination program will help drive economic recovery and reduce credit losses.

“Banks were as much in the crosshairs during the initial stage of the COVID outbreak as anything,” Brian Levitt, Invesco’s global market strategist, told MarketWatch, adding that the big fear in any recession is that stress will find its way into the banking system.

But those concerns subsided after the Federal Reserve stepped in with a raft of emergency lending facilities, including buying up corporate debt for the first time ever this spring.

Now there’s optimism around the vaccine rollout helping to spur further economic recovery in 2021, Levitt said, adding that the expectation is that the 10 year U.S. Treasury yield TMUBMUSD10Y, 0.941% also will likely move higher, helping banks which lend based on the benchmark.

“That type of environment favors cyclical assets, and that’s largely the banks,” he said.

Bank shares closed lower Tuesday, but rallied to kick off Christmas week, after the Fed on Friday gave lenders the green light to start buying back stock again in 2021, a reversal of restrictions put in place in June amid concerns about the COVID-19 pandemic.

The Dow Jones Industrial Average DJIA, 0.67% fell 200 points Tuesday, pressured lower by concerns about a new strain of the coronavirus in the U.K. that curbed travel from the nation to swaths of the globe.

Bank bonds issued by Morgan Stanley MS, -0.49%, Wells Fargo & Co. WFC, +0.02% and Goldman Sachs Group Inc. GS, -1.22% also were among the top 10 most actively traded debt since Dec. 11.

Bucking the broader rally was debt issued by a handful of companies, including Verizon Communications Inc. VZ, -0.55%, Ford Motor Co. F, -0.67% and Apple Inc. AAPL, -0.48%.

BondCliQ CEO Chris White weighs in on the retail industry’s debt

News on newly issued securities in the Americas 16 November 2020

Market Extra

Junk-bond investors are hunting for treasures in the pandemic scrap heap

Published: Nov. 12, 2020 at 3:32 p.m. ET

Fallen angels in focus

Call it the Antiques Roadshow of the corporate bond market.

Even as COVID-19 cases surge to alarming rates and rattle markets, debt investors in November have been rummaging through the U.S. corporate bond market for bargains created by the pandemic.

The debt of “fallen angels” Ford Motor F, -1.44% and Occidental Petroleum Corp. OXY, -4.95% was among the most actively traded by midmonth, amid an overall sea of green for U.S. speculative-grade, or “junk-rated” corporate bonds so far in November, according to data from BondCliq.

Both the debt-laden Ford and oil and gas producer Occidental saw their coveted investment-grade credit ratings cut to junk territory, or BB+ or lower in March as the coronavirus bore down on the U.S.

This chart shows the top 24 U.S. junk-bond issuers by trading volume so far in November, with Ford’s debt the most actively traded.

Top 24 junk-bond trades in Nov. BONDCLIQ

Green colors indicate a broad rally in bonds from Nov. 2 to Nov. 12, even though the Dow Jones Industrial Average DJIA, -1.08% was down 1.3% on Thursday and the junk-bond market was selling off.

The iShares iBoxx High Yield Corporate Bond ETF HYG, -0.67% was down about 0.5% Thursday, but still up 1.7% for the month, according to FactSet. The VanEck Vectors Fallen Angel High Yield Bond ETF ANGL, -0.45% slumped 0.5% Thursday, but was on pace for a 2.5% monthly gain.

BondCliq data also shows that nearly $50 billion worth of junk-bonds traded already his month, a 16% uptick from the same period of October.

The continued hunt for bargains followed a dramatic selloff in October for equities and debt markets, as parts of Europe rolled out fresh curfews and restrictions on social gatherings as COVID-19 infections hit records.

And alarming new milestones in the pandemic this week, including fresh curfews on bars and restaurants in New York City and elsewhere, cut into a rally in riskier assets sparked earlier in the week by promising developments on the COVID-19 vaccine front.

But what might be another period where bad news may be good news, debt investors looking for fallen angel bargains could be in luck, particularly as already struggling corporations grapple with the added shocks of the pandemic.

“We couldn’t be more excited as fallen angel and high yield investors,” said Manuel Hayes, senior portfolio manager of Mellon’s Efficient Beta Fallen Angels strategy. “In our view, the more downgrades there are the more discounts are available for those who can cost effectively and efficiently harvest this opportunity set.”

This year already has seen some $170 billion of formerly U.S. investment-grade corporate debt downgraded to junk-bond territory, according to BofA Global analysts, who expect another $50 billion to cross over in the next 12 months.

The potential for a deluge of corporate debt downgrades that could swamp the junk-bond market has been a key concern for investors, central bankers and regulators for years.

Those worries turned feverish this spring, after states and cities across the nation ordered businesses to temporarily close in a bid to contain the first wave of U.S. COVID-19 outbreaks.

But sentiment around corporate debt also quickly shifted to bullish from bearish after the Federal Reserve in April expanded its foray ever into buying corporate debt to include “fallen angels,” as it looked to stabilize markets that began to spiral out of control in March.

Hayes pointed out that as bonds pass from investment-grade to junk territory, they can create a wave of forced selling, because many investors often lack a mandate to own both types of debt, but when oversold this creates an opportunity for other investors to buy cheaply.

Kohlberg Kravis Roberts & Co.’s KKR Credit also pointed out that fallen angles produced an eye-popping 31.3% total return in the highly volatile stretch from the March 23 pandemic low to Sept. 30, which compared with a 18.42% return for investment-grade corporate bonds, in a note recapping third-quarter performance.

What the upcoming Supreme Court ACA hearing could mean for debt of healthcare companies

With the presidential election looming as well as a Supreme Court hearing on the Affordable Care Act, BondCliq CEO Chris White joins Yahoo Finance to discuss how the debt of healthcare companies has performed.

https://news.yahoo.com/upcoming-supreme-court-aca-hearing-162127319.html

In One Chart

Extra compensation offered if Boeing’s credit ratings fall into “junk” category

Boeing Co. returned to the borrowing trough on Thursday with a four-part bond deal, a day after reporting third-quarter results that weren’t as bad as Wall Street feared though they highlighted the embattled aircraft maker’s significant cash burn.

Bankers and investors still need to haggle over the ultimate size and price of Boeing’s BA, -3.10% new debt financing, but order books for the transaction already have reached about $12 billion on what could end up being at least a $4 billion pile of fresh corporate debt, according to an investor monitoring the transaction.

Boeing said in a public filing Thursday that it may use proceeds from the bond sale to repay near-term debts. The company had $3.6 billion of short term debt due, according to a report from CreditSights.

Pushing out maturing debts into the future has been a lifeline for cash-strapped U.S. corporations hard-hit by the pandemic, with air travel still almost 70% below levels seen before the pandemic.

In addition to announcing more staff cuts, Boeing on Wednesday also reported that it burned through $5.1 billion of free cash flow in the third quarter, or less than its $5.6 billion cash burn in the second quarter, as the company continues to grapple with the economic toll of the pandemic and its still grounded 737 Max fleet program.

Boeing assumes that passenger air traffic will return to 2019 levels in about three years, even as Europe and parts of the U.S. battle once again with record COVID-19 cases.

Initial price guidance on its new bonds ranged from a spread of 195 basis points above Treasurys TMUBMUSD10Y, 0.856% for its 3-year class to 300 basis points above the risk-free benchmark for its longest 10-year parcel, according to Ashwin Tiruvasu at CreditSights. Those levels often move with investor demand.

Spreads are the level of compensation investors earn on bonds above a risk-free benchmark, with increasing spreads often pointing to a riskier asset or market tone.

U.S. stocks were on the climb Thursday after Wednesday’s rout left the Dow Jones Industrial Average DJIA, -1.46% down 943 points.

In the bond market, Boeing’s debt was under pressure and among the most actively traded of the Dow’s 30 companies on Thursday, even when looking at debt maturing in five years, 30 years and beyond, according to BondCliq data.

Boeing bonds under pressure BONDCLIQ

Tiruvasu at CreditSights said that Boeing bond’s initial price levels likely weren’t enough to “fully compensate investors” for the risk of the company’s credit ratings being downgraded to “junk” or the speculative-grade category.

Fitch Ratings cut Boeing’s corporate debt ratings one notch to BBB- from BBB, with a negative outlook on Thursday, effectively putting the debt on the cusp of falling into the junk category. The credit rating firm pointed to a “prolonged recovery from the pandemic” compared with Fitch’s “original expectations,” as well as the challenges to Boeings financial metrics due to its grounded 737 Max operations, as forming its rationale.

Like Boeing’s prior bond deal in April, the new bonds will offer investors concessions if the debt loses its coveted investment grade ratings. Specifically, investors in the new bonds would earn another 25 basis points of additional spread per each ratings notch cut by Moody’s Investors Service below its current Baa2 level or S&P Global’s BBB- grades, the cusp of junk territory.

Regulated Price Transparency …

In One Chart

Longer-term outlook cloudier for banks

Third-quarter corporate earnings kicked off this week with debt investors taking a more bullish view on big banks over the next five years.

That’s at least the signal coming from the bond market, where investors have been busy snapping up shorter-term bank debt on the view that major lenders can benefit as the economy heals from the worst of the coronavirus crisis.

This chart shows clusters of trades concentrated in shorter-term bank debt since Monday, when Wall Street’s biggest lenders kicked off corporate earnings in earnest.

Betting on short-term debt – BONDCLIQ

Green bubbles signify trading in big-bank bonds where spreads have tightened, often due to higher demand or the perception that an asset poses less of a default risk. Red bubbles point to more risk-averse trading. Spreads are the level of compensation investors earn on a bond above a risk-free benchmark, often U.S. Treasurys TY00, -0.04%.

The more bullish tone for bank debt comes as the industry enters the homestretch of a punishing year, with banking shares still down about 30% on the year to date, even as a handful of technology companies have helped major U.S. stock indexes trade near record territory.

However, Goldman Sachs analysts think the time might be ripe for downtrodden sectors like banks to shine.

Back in the bond world, debt from Bank of America BAC, 0.39% was the most actively traded on Thursday from the financial sector, accounting for $703.2 million worth of trades and 7.1% of the day’s overall action, according to BondCliQ, a corporate-debt tracking platform.

Drilling down, Bank of America’s 2.5% coupon bonds due in two years were the most active from its five-year maturity range, even as spreads on the 2022s narrowed by about 6 basis points, according to BondCliQ.

In other words, investors were buyers, even though the bonds paid less.

In other debt trading Thursday, Morgan Stanley MS, 0.50% bonds were the second-most active among financials at a 5.3% share, when looking only at a five-year maturity horizon, followed by Citigroup C, -0.56% at 4.4% and JPMorgan Chase & Co. JPM, 0.02% at 3.9%, per BondCliQ.

Equity investors also took a more positive view on Bank of America on Thursday as shares rose 2.2%, a reversal from a day ago when it reported better-than expected profit for the third quarter, but revenue that fell more than forecast. Executives provided an upbeat outlook for net interest income next year.

“There isn’t much to complain about in 3Q20,” wrote Jesse Rosenthal’s team at CreditSights, of Bank of America’s results, other than “softer trading perhaps, but that may well be risk positioning.”

However, the CreditSights team did point to “management’s relatively more bullish macro commentary” that set it apart from its peers, and warned that “those rosier expectations could boomerang if the recovery falters.”

By Chris Brummer and Evan Campbell

Debt markets signal the big banks will see a strong earnings season

https://www.cnbc.com/video/2020/10/12/debt-markets-signal-the-big-banks-will-see-a-strong-earnings-season.html

This under-the-radar pattern suggests Macy’s on path to bankruptcy unless the Fed intervenes

Microsoft’s potential purchase of TikTok carries a wide range of risks, and throws them directly in the middle of a simmering US-Sino conflict, big-tech scrutiny and turbulent domestic politics. How will these factors play out over the next month as the September 15th deadline looms, and how will the debt of Microsoft react to a deal, or lack thereof?

BondCliQ Institutional Market Monitor - TikTok - August 10th, 2020Using BondTiQ, you can easily observe the past and present trends of specific issuers like Tesla, and watch how bond investors are cautiously positioning themselves as Tesla’s stock price continues to drive forward.

BondCliQ Institutional Market Monitor - Tesla - July 29th, 2020Using our BondTiQ visual application, we can observe the trends of Hertz’s outstanding corporate debt throughout 2020 to observe how the bond market reacted.

BondCliQ Institutional Market Monitor - Hertz - July 8th, 2020

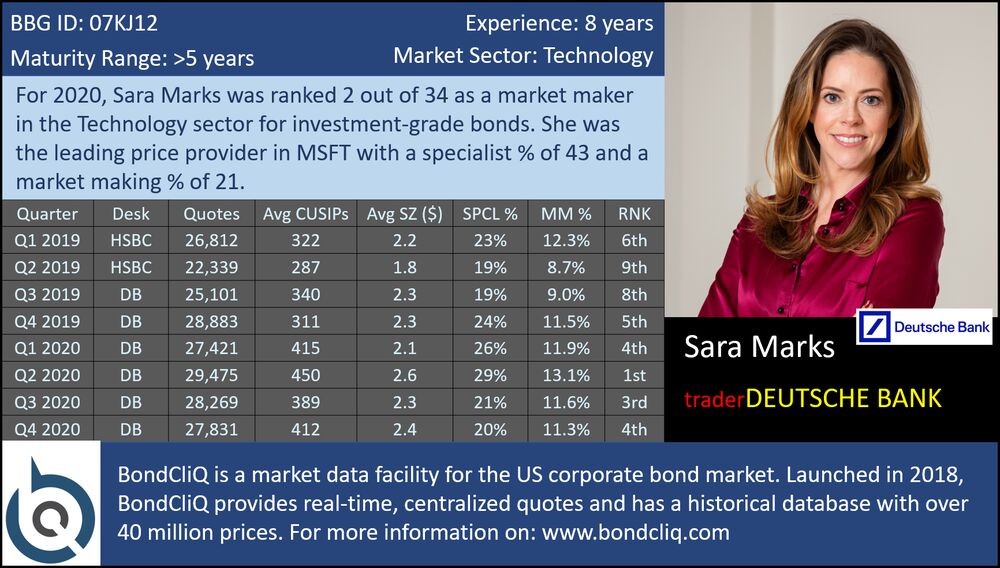

Moneyball for Bonds Aims to Rank Traders Baseball Card-Style

By-

BondCliQ to use stats to shed light on trader performance

-

Paul DePodesta, who remade Oakland A’s with stats, is involved

Wall Street bond traders may soon be immortalized in the fashion of baseball legends Honus Wagner, Willie Mays and Pete Rose if a plan by a former Goldman Sachs Group Inc. executive takes off.

That’s right, baseball cards are coming to finance.

The brainchild of Chris White, founder of bond trading and analytics firm BondCliQ, the digital cards reflect a new statistical approach to measure the effectiveness of individual traders and salespeople on dealer bond desks. White brought in as an investor Paul DePodesta, who used novel statistical methods to elevate the Oakland Athletics baseball team to a title contender, a story captured in the Michael Lewis book “Moneyball.”

The bond market has historically leaned on one metric for success — did a trader make money? BondCliQ wants to shed some light on whether rainmakers are good or lucky. It is collecting data that can allow buyers such as hedge funds or other institutional investors to identify the best dealer traders in a given sector or security. And dealers can see how they rank among competitors. Presumably, traders who top the list year after year could use the stats to argue for better pay.

“Here we are in a market where data is king, but we have very little information on who is qualified,” White, the firm’s chief executive officer, said in an interview. “The buy side wants to know who they should engage. The dealers want an opportunity to show why it should be them.”

The data will include market sector, average maturity of debt bought and sold and the number of quotes provided, according to a mock card provided by White. The firm will also calculate stats called specialist percentage and market-maker percentage.

The specialist percentage is “when you make a price that’s normally the best price in the market,” White said. The market-maker stat denotes traders who “are the market,” he said. The end goal is to create better bond prices by putting both individual and bank reputations on the line.

The effort comes as the market is bigger and perhaps riskier than it’s ever been. U.S. investment-grade companies have sold more than $1 trillion in new corporate debt in each of the last eight years — and the fastest pace was set in 2020, when the mark was reached in May.

BondCliQ is creating a system to collect, maintain and publish stats on bond traders and salespeople by bank. It has 34 dealers that voluntarily provide pricing data, White said. The firm supplements that with some public information such as Trace-reported deal size and price to derive the stats.

Read more: Goldman alum touts ’70s era fix to bond market’s big problem

White was at Goldman Sachs from 2010 to 2015, where he created GSessions, a bond-trading system that has since been shut down. He’s also CEO of advisory firm ViableMkts LLC.

Bloomberg LP, the parent of Bloomberg News, competes with BondCliQ in providing bond-price information.

DePodesta joined the Oakland A’s as an assistant to general manager Billy Beane in 1999 and was general manager of the Los Angeles Dodgers from 2004-05. Now the chief strategy officer for the National Football League’s Cleveland Browns, he said in an interview that he was attracted to BondCliQ by the chance to bring a systemic organizing approach to the market.

“What we were able to do in baseball is aggregate a lot of the data to better understand the world we were operating in,” he said. “I saw the same opportunity here but on a much greater scale.”

DePodesta said he’d assumed there was a certain level of price transparency in the bond market, but there isn’t.

‘Can’t Believe This’

“With each conversation there was almost an ‘I can’t believe this’ moment — this is the way it’s done?” he said. If a bond desk makes $500 million a year “is that good?” he said. “Should that have been $1 billion or should it have been $2 million and they hit it out of the park?”

DePodesta said the use of stats to improve bond-trading performance will mirror his experience in professional sports, which was part of the inspiration for Jonah Hill’s character in the movie adaptation of Lewis’s book.

“It’s a march to the inevitable here. It was the same with baseball, it’s the same with football,” he said. “The need is so overwhelming you won’t be able to resist it.”

White wants BondCliQ to show bond traders how they stack up against counterparts at other banks so that pricing improves across the board. He said his firm will send report cards to dealer-desk heads by the end of this month and the rankings will be visible to buy-side clients in early July.

“Dealers really want to compete for order flow,” he said. “The best way to compete is if there’s more data around performance.”

— With assistance by Dan Wilchins

Bonds Markets Descended Into Chaos. Now Pros Are Calling for Structural Change.

With the market downturn in March exposing problems with the integrity of bond prices, market participants say a fix is overdue.

March’s market downturn unveiled long-standing problems with the process for calculating critical net asset values — the value of a portfolio’s holdings for bond mutual funds, credit hedge funds, and fixed-income exchange traded funds. Now, after decades of inertia, bond market participants are calling for changes in fixed income market structure.

Until markets stabilized later in the spring, some credit hedge funds suspended redemptions because they couldn’t guarantee the accuracy of their NAVs, and fixed-income ETFs traded at record discounts.

Reginald Browne, principal at GTS, the largest NYSE market maker, recommended — among other changes — creating a fixed-income securities information processor, or SIP, to distribute aggregated bond market data. Speaking at a recent Securities and Exchange Commission meeting of the Asset Management Advisory Committee, Browne said the proposal would improve the source data for valuations, allow market makers to automate trades, close bid-offer spreads, and ultimately create more liquidity. A SIP is used in U.S. equity markets to consolidate quotes and trades from multiple trading venues.

BondCliQ, a technology firm that centralizes post-trade and pre-trade pricing information for U.S. corporate bonds, said it has a live version of what Browne is talking about. Bondcliq is making its service available through order management systems, such as Charles River Development’s OMS, which is one of the largest. This is the first time that the buy side — asset managers and investors — and dealers will be looking at the same information at the same time.

“We’re just doing what Nasdaq did in 1971, which is aggregating quotes from market makers. After that turnover for unlisted stocks took off,” said Chris White, founder and CEO of BondCliQ, in an interview. (In 1971, Nasdaq initially automated quotations of stocks that changed hands over the counter, similar to how bonds trade today.) “The liquidity issues that we’re having, the NAV issues, all come down to data quality.”

The prices for stocks, which trade on an exchange, are available in real-time. But bonds still trade over-the-counter, meaning a dealer and an investor negotiate a price, whether online or over the phone. As a result, investors, dealers, and others have no central place to find bond prices.

Bond mutual funds, for example, use what are called evaluated prices from third parties such as ICE Data Services. ICE’s analysts and algorithms gather and assess multiple sources of information scattered throughout the market to provide evaluated bond prices to investors, asset managers, dealers, and others. In March and April, as markets cratered and trades ground to a halt, accurate pricing information also disappeared.

Even though no one questions transparency in equity markets, calling for something similar in bonds is still controversial. Asset managers interviewed for this article didn’t want to go on the record on the subject. Some said they didn’t want to alienate dealers they rely on for execution. Others said some in-house traders opposed transparency because it could threaten their jobs.

“In the equity markets, you see trade and quote data, and it’s all regulated,” said Michael Beattie, director of product strategy at Charles River. “In fixed income, institutional traders have to piece together information from multiple sources. The crux of this is, how do you trust the pricing you see?”

Video summary of comments made by BondCliQ CEO Chris White at the recent SEC FIMSAC meeting on bond pricing services:

No One Knows What Their Bond Fund Is Worth

The integrity of the process of valuing funds broke down with the markets in March. The SEC is trying to figure out why.

During the worst of the market chaos in March, some credit hedge funds suspended redemptions because they didn’t know what their holdings were worth and the prices of fixed income exchange-traded funds were out of whack with the net asset value of their underlying bonds.

The prices for stocks, which trade on an exchange, are available in real-time. But bonds still trade over-the-counter, meaning a dealer and an investor negotiate a price, whether on a screen of over the phone. As a result, there is no central place to go for bond prices. Bond mutual funds, for example, use what are called evaluated prices from third parties such as ICE Data Services. ICE has analysts and algorithms gathering and assessing multiple sources of information scattered throughout the market to provide evaluated bond prices to investors, asset managers, dealers, and others.

In March and April, as markets cratered and transactions ground to a halt, that information evaporated.

The Securities and Exchange Commission is now looking into what went wrong. While credit markets have stabilized since the U.S. Federal Reserve announced support programs at the end of March, market participants still question the validity of the process of calculating net asset values.

“The whole idea is how we take sparse data — first of all gather as much data as possible — and extrapolate that to 2.8 million securities every day,” said Mark Heckert, chief product officer of ICE Data, speaking during a webcast of a panel discussion held by the SEC’s Fixed Income Market Structure Advisory Committee on Monday.

At the end of March, the Intercontinental Exchange postponed rebalancing of its ICE indexes for a month.

“In a market like we saw in March, there is a phenomenon of distressed transactions. You have to try to ascertain if a transaction occurred orderly or not, and make a determination if that was a fair value or not,” said Heckert. “Our job is trying to represent a good-faith opinion of where a bond would trade in an orderly market. We need to suss out in times of crisis what’s orderly and what’s not.”

Derek Hafer, head of U.S. investment grade trading at Citibank, added, “We find that across various pricing services that there are a lot of discrepancies. We have to kick out the large outliers. As volatility increases, the dispersion in the different third-party marks in the same instrument goes up.”

Ironically, critics have been calling attention to fixed income exchange-traded funds, because many of them were trading at huge discounts to their net asset values — the value of their underlying portfolios. But ETF experts say that counterintuitively, the prices of ETFs, which trade on an exchange, were accurate representations of the value of those ETFs’ entire basket of securities — even if prices couldn’t be determined for the individual bonds.

The larger problem involves mutual funds, which don’t trade on an exchange and whose net asset value is used when investors buy and sell shares in their funds. Asset managers of mutual funds and institutional separate accounts only calculate NAVs once a day based on data from services such as ICE.

Chris White, founder and CEO of BondCliQ, a centralized pricing system that aggregates pre-trade institutional quote data, thinks everyone, including regulators, needs better and more information. One option is getting better pre-trade data about bonds to dealers, so they’ll be more willing to step into volatile markets, make transactions, and keep the flow of information going.

“If pre-trade data were organized in the first place, it would be easier to figure out where a bond should trade. Dealers could then provide liquidity,” said White during the advisory committee meeting. White said he envisions BondCliq providing its source data to pricing services such as ICE, rather than establishing a separate offering.

“In March, [ICE] had ten times the number of questions around the soundness of pricing. It’s because the underlying source data that they rely on to calculate the evaluated prices broke down,” said White. “Without more data points from dealers, it will be very challenging to continue to support a market that is growing in size and risks.”

Using our BondTiQ visual application, we can take a closer look at the performance, volume and customer flow of each REIT sub-sector throughout the COVID-19 crisis to observe how the corporate bond market has responded.

Institutional Market Monitor - May 20th, 2020Using the BondTiQ application, we drilled down into “fallen angels;” investment-grade corporate bonds that were subsequently downgraded to high yield. The BondTiQ Issuer Screens tell us performance, customer flow, and volume activity before, in between, and after these Fed announcements for these “fallen angels.”

BondCliQ Institutional Market Monitor - Fallen Angels - May 11th, 2020How corporate bond data sourced from BondTiQ can be leveraged to predict the arrival of a COVID-19 vaccine.

BondCliQ Institutional Market Monitor - Vaccine Developers 3.0 - April 29th, 2020 (1)Using data sourced from BondTiQ we can illustrate the trends in institutional (>$1MM) Alternative Trading System (ATS) activity since the start of 2020.

BondCliQ Institutional Market Monitor - Friday April 17th 2020 (3)Using the data visualization application, BondTiQ, we can compare customer flows per sector for LQD constituents relative to the overall market when the ETF “dislocation” began on March 12th.

BondCliQ Institutional Market Monitor - Tuesday March 31stBondCliQ CEO Chris White joins Yahoo Finance’s On The Move to discuss how the Federal Reserve has handled the coronavirus pandemic.

Pre-trade data: The next generation

The first generation of pre-trade analytics are consolidating; the second generation of price and liquidity providers such as Bondcliq and Katana will need to learn from this if they are to thrive.

The range of pre-trade analytics providers has shrunk in the past six months, with provider Algomi now reportedly being acquired by interdealer broker BGC, following the closure of its rival B2Scan which folded in late 2019. Having formed in 2012, neither was able to achieve profitability independently.

In 2015 their prospects had been good; 54% of traders planned to use Algomi, and 13% planned to use B2Scan according to the Trading Intentions Survey that year. There was an information chasm on bond trading desks. Until a buy-side trader picked up the phone to one or more broker-dealers, they had to rely upon their experience and market knowledge to know who could trade or at what price. Equally, unless the sell-side sales team checked internally they could not be sure what they could buy/sell and at what price.

Their offering, to capture data on pricing and liquidity, then providing analytics to guide traders on where to trade and at what price, had clear benefits to traders. The uptake of some services in this area has been very high. Neptune, which launched as a contemporary of Algomi, providing a standardised electronic flow of dealer axes to the buy-side, has been a notable success.

A second generation of services have now developed in this space. The question will be whether this new generation can create a more viable commercial model for providing this intelligence.

Ownership of data

The issue of data ownership has historically been a thorny one for large data aggregators, including Refinitiv, Bloomberg and exchanges. They have faced calls from traders and dark pool operators – who generate much or all of the data – for lower charges and easier access to it. The counterpoint is always that the aggregated data has value beyond its constituent parts.

“We exist because the people who initiate the production of the data want to take control of it, and that’s primarily dealers, but to an increasing extent the buy side as well,” says Byron Cooper-Fogarty, interim CEO at Neptune. “As data becomes increasingly important and valuable, it’s really going to be interesting to see how that plays out.”

Neptune initially operated without charging buy‑side firms, but brought in a £16k per year price for the service which has increasingly become accepted.

Smaller pre-trade data providers need to prove that they can deliver a need-to-have service in order to get buy-in from traders for the service they are offering. However, they are challenged at two levels by the existing market structure.

The first challenge is in getting access to data in the first place. Price makers and venues need to see value in streaming their prices via a mediated service.

“Each of the individual trading venues has a very unique view into the marketplace,” says Kevin McPartland, head of market structure and technology research at Greenwich Associates. “And they also increasingly understand the value of the data that they are collecting from traders, so they are not in a hurry to allow another third party to take that data and put it all in one place, as it minimises the value of that asset for them. That made it hard for some of these third-party data providers to come to market, or show the buy side something that’s really enticing.”

Secondly, venue operators are able to use their own data to build services which can support pre-trade decision-making. MarketAxess has developed a composite price (CP+) which has gained considerable support as a mid-point.

David Krein, global head of research at MarketAxess says, “We have seen the adoption of CP+ on the buy and sell side move from being a display point on our screen, to become the foundation of our internal crossing tool in Europe, and also for our auto-execution tool.”

The public data found in US corporate bond markets via the Trade Reporting and Compliance Engine (TRACE), run by Financial Industry Regulatory Authority (FINRA), a private corporation and self-regulatory body, gives the market a baseline dataset of post-trade bond prices. Although MiFID II attempted to create greater transparency in Europe, it has yet to lead to a similar consolidated tape.

“There is [greater hunger in Europe], because MiFID II in corporate bonds has largely been a miss,” says Krein. “That hole in the market creates demand for data tools. TRACE is not perfect; it is quite unwieldy, it has a lot of moving parts and it hasn’t changed in half a decade. It was in some ways ahead of its time, but as execution becomes more electronic and automated TRACE is less able to fulfil the needs of traders.”

For firms that do not have the data, clever ways are being found to build that information up, in order to deliver a picture of the market that is valuable.

Appetite for change

The need for better tools stems from the conflicts of interest that exist under current models, says Chris White, CEO of Bondcliq, which pulls bid, offer and size data together and feeds it to the buy side, with dealers given feedback on the quality of the prices they are making.

The need for better tools stems from the conflicts of interest that exist under current models, says Chris White, CEO of Bondcliq, which pulls bid, offer and size data together and feeds it to the buy side, with dealers given feedback on the quality of the prices they are making.

“The approach to data up to this point has been privatised micro-networks of data in the institutional markets,” he says. “The main problem with that is that you are not improving; when you have a privatised network of data the reliability of that data for trading is automatically corrupted. If you play poker and you are the only one that gets to see the flop, there isn’t going to be a lot of action on the poker table.”

Santiago Braje, CEO of Katana, which offers an AI-derived bond price, argues that there is also increasing demand stemming from the changing execution model.

“We come from a market that was essentially built on bilateral relationships and trust,” he says. “Historically a PM would work with some banks that they would trust and regularly would get liquidity from. The industry is still organised as if things continue to work like that, but this is not the reality anymore. Those trust-based relationships where effectively you would get a different price from everyone else, because the dealer would make different prices to different people, is in a transition period.”

He sees this transition as characterised by the joint trading styles of smaller electronic orders pushed out to multiple dealers in competition, in a relatively transparent model, with block trades happening via voice or in non-comp dark trading.

“This move from analogue to digital reflects a shift from bilateral communications to multilateral communications,” he argues. “It was fairly easy to make that change for smaller trades, it’s much harder for blocks because information is much more sensitive. So you don’t put things out there for everyone to see, because it works against your own position.”

Path to success

Certainly, buy-side traders are becoming more open to new ways of consuming data, in no small part driven by increased opportunities for electronification or automation of the trading workflow.

“We have found the way the buy side consumes data, particularly larger asset managers, has gone from being GUI-based to more API-driven,” says Cooper-Fogarty. “Over the last 12 to 18 months most of our users have gone from accessing data through our GUI, to connectivity either via an OMS, an EMS or a data aggregator such as ALFA. Over a third of our clients now use direct APIs, although our clients will often consume Neptune data through multiple connections.”

The make-up of data users via Neptune has also changed, with 80 per cent being traders and 20 per cent increasingly portfolio managers and research analysts.

White sees increased connectivity with trading tools via APIs as an enabler to success, where traders were once the only users.

“Our next obstacle is not to get the dealers to share the data, it’s to get the dealers to interact with the data seamlessly,” he says. “So we are now plugging into the dealer systems, the pre-trade data. Why a buy-side trader should care is because the integrity of the data is directly linked to whether or not the dealers can see the position of the price. Dealer visibility equals dealer confidence, equals more reliable institutional liquidity, that’s the way we see the world.”

©The DESK 2020

Bond ETF turmoil exposes credit’s faulty wiring

NEW YORK – Ignorance may be bliss sometimes, but not in the bond market. During this month’s financial carnage, some fixed-income exchange-traded funds traded at a significant discount to the value of their underlying assets – by 5% at one point, for one that BlackRock’s iShares division manages, the biggest gap since 2008. But it’s not an ETF problem.

Total global assets in bond ETFs stood at more than $1 trillion at year end after net flows ballooned over the past decade. As tradable shares, they can be liquid. The vast majority of corporate bonds, meanwhile, rarely change hands, creating a mismatch between the fund and its underlying securities. It also means these ETFs can be a better indicator of shifting market sentiment.

There’s also a lack of transparency. Much debt trading still involves working with market makers, who themselves normally have limited presale data. Only around 30% of investment-grade U.S. corporate debt was traded electronically in February, according to Greenwich Associates; it was less than half that for U.S. high yield paper.

True, industry regulators have a system for disclosing trade details. And firms like MarketAxess and BondCliQ are making the market less opaque by either reducing the role of middlemen or providing better data. But many bond investors still have a hard time figuring out if they’re getting the best price.

New emergency programs allow the Federal Reserve to buy corporate debt and ETFs, an announcement which by itself probably helped support prices. If the Fed does jump in, that may also limit significant future dislocations between ETFs and their underlying bonds – even if the Fed doesn’t actually buy tons of corporate debt.

Transparency is not such an easy fix. The sudden presence of a buyer who is also a watchdog may prompt market makers to up their game for now, as much as they can. After all, a player using public funds ought to ensure it’s getting a fair price. Longer-term fixes require more innovation, perhaps even regulation. The Fed’s new role may be just the prod the market needs.

CONTEXT NEWS

– Bond exchange-traded funds, including BlackRock’s iShares iBoxx Investment Grade Corporate Bond ETF and the Vanguard Total Bond Market Index Fund ETF, have recently traded at significant discounts to their net asset values. The BlackRock ETF traded at a 5% discount at one point – the widest since 2008.

– During the week of March 16, BlackRock raised the fees market makers must pay to redeem shares of its iShares Short Maturity Bond ETF, causing the ETF share price to fall 6.2% on March 19; it has since risen around 5%. Vanguard also introduced fees for cash redemptions for its Vanguard Total International Bond ETF.

– In the week ending March 18, taxable bond ETFs had $13.2 billion in net outflows, according to Reuters.

https://link.bloomberg.fm/BLM3262733641

For a long time, people have been warning that corporate debt could be the major source of vulnerability in today’s economy. And the market meltdown that we’ve been seeing since the beginning of March could make those fears a reality. On this week’s podcast, we speak with frequent Odd Lots guest Chris White of Viable Markets, on how the extreme search for yield in recent years, combined with massive issuance of debt, combined with the idiosyncrasies of the corporate debt market, could be a setup primed for disaster.

Running time 41:25

The Week That Changed the Corporate Bond Market

Over the years, there have been two camps on corporate bond market structure that hold very different opinions. One group has steadfastly promoted the idea that innovative solutions have improved corporate bond market trading conditions (“we don’t believe there is a liquidity crisis whatsoever”). The other group has warned that the relative calm we’ve enjoyed in the market over the past decade, thanks to central bank intervention, has masked material structural issues that will have negative consequences on corporate bond market liquidity.

The week of 3/16 to 3/20 has exposed which group has been woefully mistaken.

I Know What You Did Last Week

Horror movies are good clean fun because eventually, the credits roll, and you can return to a world where super-natural monsters aren’t behind every door. Horror markets are longer lasting and far more detrimental to your psyche. To be clear, a substantial downturn in market value is not what terrifies market participants because volatility creates opportunity. What causes real panic in any market is when trading conditions deteriorate to the point where trade execution is severely compromised. When this occurs, both buy-side and sell-side institutions face the same situation. It’s a crowded room, and the exits are blocked. Now you’s can’t leave.

Horror movies are good clean fun because eventually, the credits roll, and you can return to a world where super-natural monsters aren’t behind every door. Horror markets are longer lasting and far more detrimental to your psyche. To be clear, a substantial downturn in market value is not what terrifies market participants because volatility creates opportunity. What causes real panic in any market is when trading conditions deteriorate to the point where trade execution is severely compromised. When this occurs, both buy-side and sell-side institutions face the same situation. It’s a crowded room, and the exits are blocked. Now you’s can’t leave.

Stand Clear of the Closing Doors

An examination of last week’s corporate bond transaction data (TRACE) illustrated three clear trends that demonstrate a meaningful deterioration of corporate bond market trading conditions:

Downward Trend in Trading Volume

Since US corporate bond markets became volatile on 2/24, we have witnessed an increase in the average daily volumes. The week of 3/16 to 3/20 was still incredibly volatile, but volumes showed signs of retreating in both investment grade and high-yield markets. Meanwhile other financial markets have been experiencing record trading volumes in response to the heightened volatility.

Contraction

A topic that has received very little attention in the corporate bond liquidity discussion is CUSIP concentration. Looking at volume and bid/ask spreads do not tell the whole story on trading conditions because those metrics omit analysis on what is available to trade. Increasing volumes over a smaller universe of CUSIPs would produce signals that give a false sense of liquidity in the market:

In conclusion, the price-based liquidity measures—bid-ask spreads and price impact—are very low by historical standards, indicating ample liquidity in corporate bond markets. This is a remarkable finding, given that dealer ownership of corporate bonds has declined markedly as dealers have shifted from a “principal” to an “agency” model of trading. These findings suggest a shift in market structure, in which liquidity provision is not exclusively provided by dealers but also by other market participants, including hedge funds and high-frequency-trading firms.

(Has US Corporate Bond Market Liquidity Deteriorated? – Fed Blog, Liberty St Economics Oct 2015)

This is not a “remarkable finding” when you consider the declining breath of trading as a factor.

Looking at the total number of CUSIPs traded on a weekly basis, the week of March 16th was down ~14% or almost 2,000 CUSIPs from the weekly average of the previous five weeks:

It is not hard to imagine how CUSIP concentration has the potential to spiral. With a smaller universe of bonds trading in the market, there are less TRACE prints for CUSIPs that are not actively traded. The longer non-active bonds go without transaction data, the harder they are to trade, which exacerbates the concentration issue even further. To think, less than a year ago, there were loud voices in the market asking for a reduction in the dissemination of transaction data. Wow.

Reversal of Customer Flows

An interesting phenomenon that we covered in a previous research note was how customer flows have remained positive in the face of COVID-19 pressure. From 2/24 to 3/13, buy-side institutions were net buyers of corporate debt with a net purchase volume of $19.1B during the period. Positive customer flows were observed in every sector. In contrast, the week of 3/16 to 3/20 had negative customer flows with net sales volume of $3.6B. Positive customer flows were only observed in 3 out of 10 sectors. This reversal has gained momentum going into this week, with $9.4B net sales imbalance from the 23rd to the 24th with every single sector showing negative customer flows.

This combination of lower volumes, less CUSIPs trading and negative customer flows raise an important question: What is happening with all the new ideas that were promoted as solutions to US corporate bond trading problems?

Are We There Yet?

There have been many exciting articles and announcements about transformative innovation in the corporate bond market. Let’s see how some concepts are holding up post 2/24:

Algorithmic Corporate Bond Trading

For several years, algorithmic trading has been touted as the future for the corporate bond market, with dealers gaining more and more confidence in the capabilities of automated decision making:

At first the “Goldman Sachs Algorithm” only handled trades below $500,000, but today anything below $2m “doesn’t get touched by a human”, according to Justin Gmelich, a senior executive at the investment bank. “In four-five years I wouldn’t be surprised if we have a lower trader headcount, and have more staff on the algorithmic side,” he adds.

(Bond Trading Technology Finally Disrupts a $50tn Market – FT May 2018)

Several sources in the market have stated that “all the algos have been turned off,” which is an ominous sign for their reliability during times of persistent volatility. This is not the case in other markets that have leveraged algorithmic trading techniques for years (ex: FX, Equities, TSYs, Futures, Options). The common denominator for consistency of algo trading is the quality of data used to maintain the pricing engine. In the corporate bond market, there is a dearth of high-quality pricing data to begin with. During times of high volatility, accurate information in the corporate bond market becomes scarce. Without improving the pricing inputs for corporate bond trading algos, they will forever be subject to service disruptions.

Several sources in the market have stated that “all the algos have been turned off,” which is an ominous sign for their reliability during times of persistent volatility. This is not the case in other markets that have leveraged algorithmic trading techniques for years (ex: FX, Equities, TSYs, Futures, Options). The common denominator for consistency of algo trading is the quality of data used to maintain the pricing engine. In the corporate bond market, there is a dearth of high-quality pricing data to begin with. During times of high volatility, accurate information in the corporate bond market becomes scarce. Without improving the pricing inputs for corporate bond trading algos, they will forever be subject to service disruptions.

Platforms Providing Liquidity

Most of the dialogue on corporate bond market structure is provided by people that have a solution to sell, current company included. Therefore, it is no surprise that a narrative that electronic trading platforms provide liquidity has been gaining momentum over the years:

In the absence of large dealer participation, New York-based MarketAxess has sought to plug the liquidity gap with its proprietary electronic trading platform, providing investors and broker dealers with streamlined access to an array of fixed-income products, Dave Simons talks to Rick McVey, MarketAxess chief executive, about the opportunities and challenges of the segment”

(MarketAxess Plugs the Liquidity Gap – MarketAxess September 2014)

The act of providing liquidity means that you are in the business of facilitating opportunities for those who seek to transact, so in a sense, yes, MarketAxess and other trading platforms could be considered liquidity providers. However, when you claim that your platform is going to “plug the liquidity gap” because dealers have stepped away from the market, you are implying that the electronic system itself acts as a risk-taking counterparty to facilitate transactions. This is extremely misleading and sets irrational expectations on what problems e-trading platforms really solve (hint: efficiency of trading).

It is dealers that are the engine of liquidity in the corporate bond market, regardless of whether the transactions occur by phone, electronic trading platform or smoke signals. If dealers back away from the market, liquidity is removed from all venues, including trading platforms. If electronic trading providers want to deliver a resilient liquidity solution, it requires consistent dealer participation. Improving access to pre-trade data for dealers is a proven technique that fosters dependable market making activity for both voice and electronic execution.

Model-Based Pricing

The absence of high-quality pricing data in the corporate bond market has created an environment where numerous model-based pricing solutions have taken hold. These solutions determine the true value of a bond by, “leveraging the relationships between bonds; based on factors such as liquidity, maturity, time since issuance, amongst other things.” While this process for determining the value of a bond may sound more like art than science, model-based pricing is the only game in town for calculating best-execution, transaction costs and most importantly, portfolio valuations. Just before the COVID-19 crisis, a new model-based pricing product had claimed a breakthrough in accuracy:

The absence of high-quality pricing data in the corporate bond market has created an environment where numerous model-based pricing solutions have taken hold. These solutions determine the true value of a bond by, “leveraging the relationships between bonds; based on factors such as liquidity, maturity, time since issuance, amongst other things.” While this process for determining the value of a bond may sound more like art than science, model-based pricing is the only game in town for calculating best-execution, transaction costs and most importantly, portfolio valuations. Just before the COVID-19 crisis, a new model-based pricing product had claimed a breakthrough in accuracy:

The pricing engine’s algorithm consumes more than 200 features and produces an unbiased, two-sided market for 95% of the tradable universe which is updated every 15 to 60 seconds, depending on the liquidity of the instrument. “The predicted prices of CP+ track traded levels very closely, and we aim for zero average difference between the two,” said Krein. “A real-time accurate pre-trade reference price for corporate bonds has not been available before.”

(Second Revolution in Electronic Bond Trading – Traders Magazine, February 2020)

While it would be great to believe that science can solve the mystery of accurate corporate bond prices, today, all model-based solutions float on an ocean of poor-quality information, so accuracy and reliability of bond portfolio valuations can be compromised. Post-COVID-19, this flaw became abundantly clear for bond funds and ETFs:

Carnegie Fonder, which shuttered a number of funds on Friday, required additional time to reach out to banks in order to determine prices. In an announcement to clients it wrote, “[We] decided to suspend trading in funds that invest in corporate bonds. As a consequence of the substantial turbulence in the market, there was a risk that the valuations (NAV) could be incorrect. It is our duty to ensure that valuations of the funds’ holdings are correct. During Saturday we reviewed all our portfolios and all their holdings.”

(Bond Pricing Battle Shutters Nordic Funds – The Desk, March 2020)

The first thing is that I took some comfort seeing that the trading was going on below net asset value (NAV)—BND was trading at a discount, I thought. For example, BND closed at $80.33 on March 12, 2020, while Morningstar shows a NAV of $85.61. That difference is huge. Unfortunately, Ben Johnson, Morningstar director of global ETF research, burst that bubble for me. He told me the NAV is based on stale prices for the bonds in the portfolio; thus, it is a bit like clocking the Olympic 100m dash with a stopwatch that only counts in 10-second increments.

(Why High Quality Bond ETFs Failed Us – ETF.com, March 2020)

There is approximately ~$10tn in outstanding US corporate bond debt. COVID-19 has exposed the fragility of the model-based pricing valuation process. This is not due to a lack of effort or technique on the part of model-based price providers. Like algorithmic corporate bond trading, high-performing, accurate model-based pricing solutions require consistent high-quality pricing data as an input.

Imagine

The innovation effort in the corporate bond market has not been in vain. There has been remarkable progress in electronic trading, algo strategies and model-based pricing. However, these solutions float on a sea of poor-quality pricing data that ultimately impairs their effectiveness when they are most needed. Imagine if the US corporate bond market had the same architecture as other modernized markets: a functioning, centralized pricing platform that improved the quality, access and reliability of price data.

At BondCliQ, we are singularly focused on improving transparency for market makers to produce the missing architecture for corporate bond market modernization: high-quality, centralized pricing data. Our approach is based on 50 years of financial market structure history. This past Friday, we had the privilege to present the details of our initiative at The Future of Market Technology Symposium hosted by Autonomous Research (Click here for video presentation of ‘Transparency and Market Liquidity’). As adoption of BondCliQ grows, imagine the positive impact the resulting data will have on dealer performance, electronic trading, algorithmic strategies and model-based pricing solutions. Now imagine what those improvements would mean for corporate bond market liquidity.

-Chris White

Are retail (<$1MM) and institutional (>=$1MM) corporate bond markets reacting the same way to COVID-19?

BondCliQ Institutional Market Monitor - Tuesday March 17th 2020Find out what’s really happening to the bonds of airlines and cruise ships since COVID-19 starting impacting travel?

BondCliQ Institutional Market Monitor - Monday, March 9th 2020The institutional corporate bond market is much more complex than simply being up or down. BondCliQ has the tools to give you the real story.

BondCliQ Institutional Market Monitor - Friday, March 6th 2020BondCliQ 9 Dealers Away From Operating Full-Scale SIP for Bonds – by Rebecca Natale (twitter: @rebnatale)

Tier-1 corporate bond dealers are still holding out from contributing their quote and pricing data to the two-year-old platform.

BondCliQ has secured 36 out of roughly 45 capital-committing dealers needed to run a full-scale Securities and Information Processor (SIP) for the corporate bond market. Similar to how other SIPs work for cash equities—the Consolidated Tape Association operates the SIP for NYSE-listed equities while the UTP Plan governs a similar system for Nasdaq-listed securities—BondCliQ is working to create an industry utility that will give investors equal access to bid, ask, and size data in the corporate bond market, and dealers a clearer view of the market. The remaining hold-outs are among tier-1 investment banks.

Because bonds trade infrequently compared to stocks, and because the organization of pricing data is lackluster at best, the valuations used on a daily basis are only as good as best guesses, says Chris White, BondCliQ CEO. For example, on February 3, the most actively-traded bond belonging to the most actively-traded issuer in the most actively-traded sector—JP Morgan, which is not quoting on the system—traded 113 times that day. After isolating the institutional trades—trades equal to and more than $1 million—113 dropped to just 17, according to the BondCliQ platform.

White says that some traders have built their own systems similar to what BondCliQ offers by having direct communication with all of the dealers, but the more pervasive problem affects the dealers—they have no idea what other dealers are pricing their bonds at.

“The question that you have to ask yourself as a dealer today is: Is my business better off with my sharing data with other dealers, and being able to accurately calculate where I should be putting my prices?” White asks. “Or, is my business better off with me trying to hoard pricing information and not being able to see what everybody else is doing?”

White draws a parallel between the dealer dilemma and the US domestic airline business of the 90s and early 2000s, when major airlines like TWA, Pan Am, and Eastern went bankrupt. Today, the masses can book any flight online. But 30 years ago, a simple flight from New York to Boston required using a travel agent, who would compare different flights because the information wasn’t yet public. The thought was, White says, if Delta knew what American Airlines’ fare was, or vice versa, it would result in a price war. But with the advent of aggregator sites like Expedia, sharing of data allowed airlines to know how best to price seats so they could sell out a flight, know when to cut ticket deals, and better understand how to optimize returns on planes and fuel.

William O’Brien, an investor in BondCliQ and former CEO of Direct Edge, which merged with BATS Global Markets in 2014, thinks 2020 will be a critical year for growth of the start-up, which went live with the first version of its system in December 2018. He anticipates the company will start to land some of those tier-1s, but right now, he says they’re playing poker.

“Yes, of course I want to know what’s in everyone else’s hands; I just don’t want to have to tell you what’s in my hand,” O’Brien says. “For the overall dealer community, the sell side is very poorly served by not knowing the quotes of its competitors because they’re costing themselves money every day.”

Exchange Data International (EDI) Partners with BondCliQ to Offer Real-Time and Historical Corporate Bond Data Product

New York, London, 3rd March 2020: BondCliQ, the first consolidated quote system for the US corporate bond market, today announced a partnership with Exchange Data International (EDI) to distribute real-time and historical corporate bond data.

Through this collaboration, EDI can now distribute institutional corporate bond quote (pre-trade) information and enriched transaction data (TRACE) that is competitive to the established providers.

Chris White, Chief Executive Officer of BondCliQ says: “There is huge demand for higher quality institutional pricing information in the US corporate bond market. By coordinating directly with 35 dealers, BondCliQ has produced the first centralized data feed. The partnership with EDI makes this valuable data set more accessible to their comprehensive network of clients.”

BondCliQ’s data is suitable for all corporate bond market participants for trading, analytics and valuations. Dealers and buy-side clients can improve their institutional trading capabilities by viewing real-time market movements, analyzing liquidity conditions and evaluating historical quote activity.

Jonathan Bloch, Chief Executive Officer of EDI says: “Fixed income markets are becoming more dependent on data to function optimally. Through our partnership with BondCliQ we will be able to cover real time and historical US corporate bond markets. These data sets are either not available or accessible through more expensive offerings. EDI is happy to give our clients new corporate bond data solutions and better options.”

The service is available through FIX API, or intraday via secure FTP files.

For more information, please visit our product page at bondcliqdev.wpengine.com or contact info@bondcliq.com.

For more information, please visit our product page at www.exchange-data.com or contact info@exchange-data.com

About BondCliQ

BondCliQ is a market data solution for the US corporate bond market. Our corporate bond market system uses a unique set of protocols to centralize and organize institutional pre-trade quotes to empower market makers to become more active liquidity providers for buy-side clients. The BondCliQ team is uniquely qualified to bring an innovative solution to the US corporate bond market because of their invaluable experience in fixed income technology and market development, including senior roles at Goldman Sachs, Blackrock, NYSE, and MarketAxess. To learn more, please visit bondcliqdev.wpengine.com.

About Exchange Data International

Exchange Data International (EDI) helps the global financial and investment community make informed decisions through the provision of fast, accurate timely and affordable data reference services. EDI’s extensive content database includes worldwide equity and fixed income corporate actions, dividends, static reference data, closing prices and shares outstanding, delivered via data feeds and the internet. Headquartered in the United Kingdom, EDI has staff in Canada, India, Morocco, South Africa and the United States.

Corporate Bonds in the Time of the Coronavirus – What story does the data tell us?

The last week of February 2020 was a reminder that markets can and will go negative. Courtesy of the Coronavirus, global financial markets saw a “prolonged correction” in every major equity market:

- The S&P 500 had its worst week since 2008 (US – NY TIMES)

- The pan-European Stoxx 600 lost 12.7%…the worst since October 2008 (EU – CNBC)

- Both the Shenzhen composite and Shenzhen component dropped nearly 5% on Friday (Asia – CNBC)

I had the honor of being invited to speak about the impact of the Coronavirus on the Yahoo! Finance news broadcast on Friday. As I watched the show before my segment, they kept flashing real-time updates of the carnage in equity markets, but not a single piece of information existed on corporate bonds. Not a profound observation in the least, but it still amazes me because the US corporate bond market is bigger and arguably more important than the stock market.

Luckily, we (BondCliQ) have the transaction data (TRACE), so our February blog post is dedicated to re-telling the story of last week, in data (and pictures).

Nobody Move, Nobody Gets Hurt

The beginning of 2020 set a record pace for new issuance:

Corporations rushed to sell $69 billion in investment grade debt this week, the second-highest amount ever in a one week period, according to BofA Securities.

Companies Issue HG Debt at one of the Fastest Paces Ever This Week – CNBC, January 10th, 2020

By the middle of last week, it was clear that the first casualty caused by the Coronavirus for the corporate bond market was the new issue calendar. Most if not all deals were canceled:

In the U.S., Wall Street banks recorded their third straight day without any high-grade bond offerings, a rarity outside of holiday and seasonal slowdowns. European debt bankers had their first day of 2020 without a deal on Wednesday. And bond issuance in Asia, where the virus first emerged, has slowed to a trickle.

Global Credit Markets Seizes Up As Coronavirus Halts Bond Sales – Bloomberg, February 26th, 2020

Delaying new deals isn’t so unusual for the corporate bond market, but the Coronavirus does beg a critical question for some of the less creditworthy borrowers: How long will I have to wait?

Red Rain is Coming Down…

So, how bad was the week for US corporate bonds. Using the BondTiQ application we can visualize the entire week of corporate bond trading activity (Feb 24th to Feb 28th):

From the looks of it, no portfolio was safe as the top 20 names by volume in each sector saw their underlying bonds lose value. The only exception for the week was Mallinckrodt, a CCC- rated, a generic drug manufacturer that agreed to settle an opioid lawsuit for $1.6 billion. Distressed bond trading is weird…

If you can keep your head about you while all others are losing theirs…(R.Kipling)

While the US corporate bond market certainly lost value, institutional investors were not panicking in the slightest. If we examine institutional transactions (>=$1MM) for the entire week, buy-side clients were net buyers of corporate bonds by a difference of almost $9 billion in notional volume:

This image illustrates why it is critical that corporate bond market data be included in the broader discussion on financial market performance. While the stock market can be relied on for accurately reflecting the present feelings of investors, the bond market articulates the longer term financial market outlook. Undoubtedly, buy-side institutions treated last week as an opportunity to pick up yield and were not dismayed by the Coronavirus.

There is even more evidence of market support when we look at the market on a sector and maturity basis. For the week, long end (>=10yr), investment-grade Financials also had positive client flow, especially for the top four issuers by volume:

Clients were net buyers of 13 out of the 16 most active issuers when looking at this section of the market. Maybe they were pricing in what is already being predicted this week, a central bank rescue plan to get markets back on track. Undoubtedly, this is a windfall for the banks, just like every other QE initiative post-2008.

Darkness Cannot Drive Out Darkness; Only Light Can Do That…(MLK)

One thing that all institutional corporate bond market participants know is that when volatility really picks up, data is at a premium. The inability to quickly capture, organize and sift through TRACE data leaves you reacting in an environment that presents meaningful opportunity. The browser-base application that created these images/insights, BondTiQ, is the most powerful tool for leveraging TRACE information. Let us help you get an edge.

If you are interested in a free trial for you and your desk, reach out to us at info@bondcliq.com.

-Chris White, BondCliQ CEO

Buy Side New Year’s Resolution – Changing Your Corporate Bond Data Diet

Every January begins with resolutions of new routines designed to create a better version of yourself. Read more books, learn something new each day, meditate each morning, etc.

Every January begins with resolutions of new routines designed to create a better version of yourself. Read more books, learn something new each day, meditate each morning, etc.

This ritual is a rare occasion when your future self is in full control and sets the agenda that your present-self must follow. Typically, it is the other way around. We favor our present self to the detriment of our future self. A late-night pint of ice cream may feel good at the time, but you’re paying for it later.

Week’s after New Year’s resolutions have been established, the bad habits gradually return. You may get through a dry January, but come mid-February, the present self is back in control, and immediate satisfaction is all that matters (it’s Wine O’Clock baby!).

As the US corporate bond market enters 2020, there is one resolution that buy-side institutions must not break: Improving their institutional corporate bond data diet.

Because the data you consume now will have an impact on your future performance.

I did it! So can you!

Celebrities are often the face of campaigns about weight loss and fitness, but their approach is costly to replicate. Personal chefs, personal trainers, and a steady supply of organic food are at their disposal. With such an edge, it is no wonder that they can rapidly and dramatically lose weight and get fit.

Celebrities are often the face of campaigns about weight loss and fitness, but their approach is costly to replicate. Personal chefs, personal trainers, and a steady supply of organic food are at their disposal. With such an edge, it is no wonder that they can rapidly and dramatically lose weight and get fit.

The buy-side landscape for institutional pre-trade corporate bond data is very similar. Over the past few years, some of the largest asset managers have been focusing on enhancing the value of pre-trade institutional, corporate bond data. These organizations have committed sizable technology resources to produce their own, proprietary pre-trade data. Their pricing information is superior in quality to what other asset managers use (IMGR, model-based prices, etc) because they capture as much information as possible, and then test and analyze the data to remove inaccurate markets and poor performing dealers. Once complete, these advanced asset-managers have a steady diet of higher-quality pre-trade data to improve their trading process, where it matters most, block execution:

“The key to best execution is having better information before you trade, and that’s what Alfa is delivering to us,” says James Switzer, global head of credit trading at AB. “We see more transparency than almost anybody.”

Risk.net – December 2016

Killer Carbs!

Access to pre-trade institutional data is not the issue for the buy-side community. There is a great deal of information available, but a material amount of institutional pricing is like junk food. It may look good and taste good, but there is no nutritional value for actual trading:

Access to pre-trade institutional data is not the issue for the buy-side community. There is a great deal of information available, but a material amount of institutional pricing is like junk food. It may look good and taste good, but there is no nutritional value for actual trading: